Top 5 predictions for 2025

In this article, JellyC’s CIO Michael Prendiville looks ahead to identify emerging trends as he presents JellyC's top five cryptocurrency predictions for 2025.

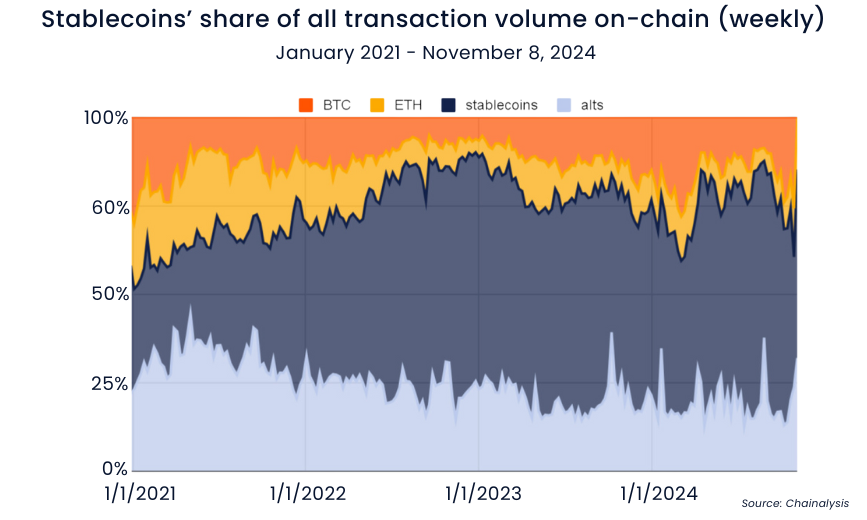

1. Fiat-backed stablecoins have a market cap of $186 billion and are expected to rise by 50% again in 2025 to approximately $280 billion. Non-USD fiat-backed stablecoins will emerge, simplifying global remittances. The country native fiat backed stablecoins will be used for merchant transactions as well as for crypto on-ramping and tokenisation vehicles. Project Acacia and the Redbelly network will help propel Australia’s move into the regulated stablecoin and Real-World Asset (RWA) markets. Project Acacia will also establish the building blocks for the wholesale Central Bank Digital Currency (CBDC) in Australia.

2. On the decentralised stablecoin side, Ethena’s USDe will continue its rapid growth, supported by yields from BTC and ETH (see funding and basis) and Blackrock’s tokenised USD yield fund (BUIDL). Competitors to Ethena will emerge in non-USD backed stablecoin protocols offering similar yields.

3. In 2025, more funds will begin the process of tokenising their share registry and establishing a 24/7 secondary market for liquid assets. The investor experience will be transformed as accessibility, transparency, and liquidity are all enhanced. The cost of running a fund will drop as registry and administration fees are significantly reduced.

4. Agents will be able to access wallets and deploy across DEXs and CEXs to execute smart order routing. This will ensure retail investors always get the best execution, helping to reduce the wealth gap. Leading CEXs (OKX, Binance, Kraken, Bybit) and DEXs (Aerodrome, Uniswap, Jupiter, Radium) will capture a larger share of the trading volume based on fee reduction and improved liquidity.

5. Pro-crypto legislation in the U.S. will make significant progress, influencing countries such as those in Europe, Great Britain, Canada, Japan, and Australia. Emerging markets in Africa, Eastern Europe, and South America will also follow suit.

Disclaimer

This article ("Article") has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any financial product or service. This Article does not form part of any offer document issued by JellyC Pty Ltd (CAR Number 001293184), a corporate authorised representative of TAF Capital Pty Ltd (ACN 159 557 598, AFSL 425925). Past performance is not necessarily indicative of future results, and no person guarantees the performance of any financial product or service mentioned in this Article, nor the amount or timing of any return from it.

This material has been prepared for wholesale clients, as defined under Sections 761G and 761GA of the Corporations Act 2001 (Cth), and must not be construed as financial advice. Neither this Article nor any offer document issued by JellyC Pty Ltd or TAF Capital Pty Ltd takes into account your investment objectives, financial situation, or specific needs.

The information contained in this Article may not be reproduced, distributed, or disclosed, in whole or in part, without prior written consent from JellyC Pty Ltd. This Article has been prepared by JellyC Pty Ltd, which, along with its related parties, employees, and directors, makes no representation or warranty as to the accuracy or reliability of the information provided and accepts no liability for any reliance placed on it. Prospective investors should obtain and review the relevant offer documents before making any investment decision.